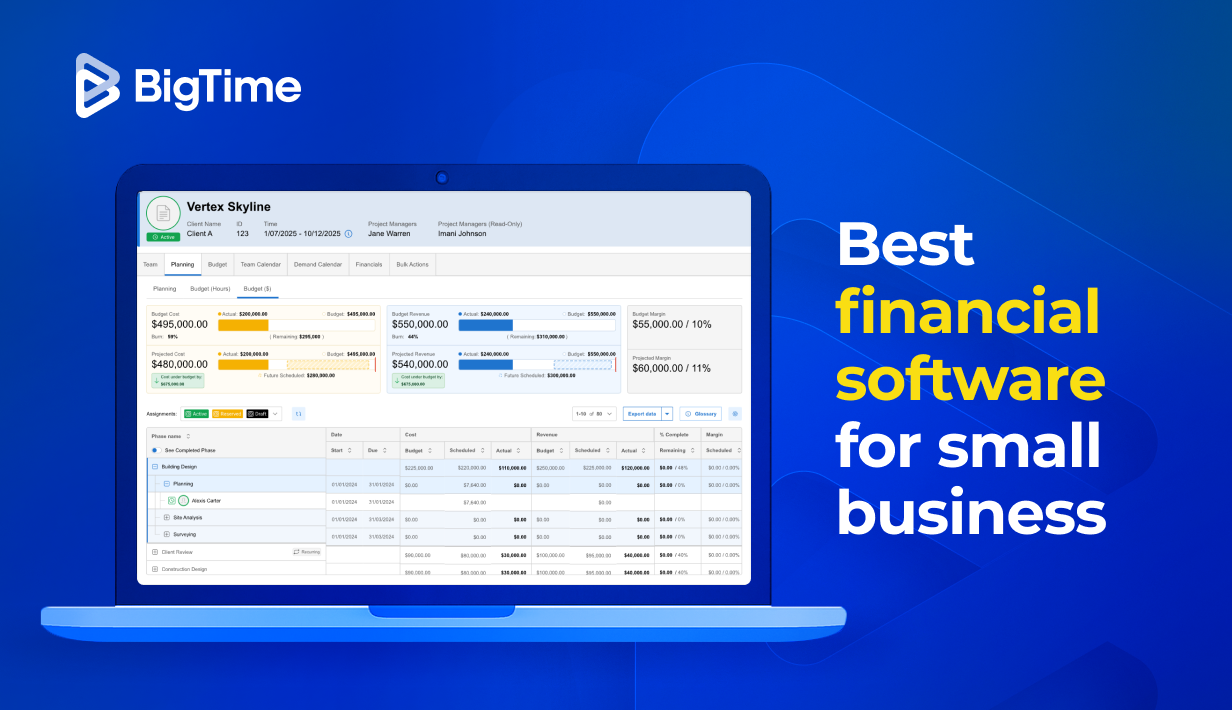

Managing your small business finances can feel overwhelming. You’re juggling invoices, expenses, payroll, and taxes—all while trying to grow your company.

What if there was a way to simplify this chaos and save you hours every week? That’s where finance software comes in. It’s designed to help you take control, avoid costly mistakes, and make smarter decisions with your money. Keep reading to discover why using finance software could be the game-changer your small business needs.

Credit: growth.techforing.com

Benefits Of Finance Software

Finance software offers many advantages for small businesses. It helps manage money easily and keeps everything organized. Using finance software reduces stress and improves business operations. Small business owners can focus on growth instead of complicated money tasks.

Streamlining Financial Tasks

Finance software simplifies daily money activities. It automates tasks like invoicing, expense tracking, and payroll. This makes managing finances faster and less confusing. Tasks that took hours can now be done in minutes. The software keeps records clear and easy to find.

Reducing Human Errors

Manual calculations often cause mistakes in financial data. Finance software minimizes these errors by using accurate formulas. It checks entries and alerts users about wrong data. Fewer mistakes mean more reliable reports and better decisions. This protects the business from costly errors and penalties.

Saving Time And Resources

Using finance software saves time that owners can use elsewhere. It reduces the need for extra staff or costly accountants. Automation cuts down repetitive work and speeds up processes. This leads to lower costs and better use of resources. Small businesses get more done with less effort.

Improving Cash Flow Management

Managing cash flow is crucial for small businesses. It ensures enough money is available to cover daily expenses. Finance software helps by organizing and simplifying this process. It provides clear insights into money coming in and going out. This clarity helps avoid cash shortages and supports better decision-making.

Tracking Income And Expenses

Finance software records every payment and purchase automatically. It shows where money is earned and spent. This tracking helps spot trends and areas to save money. Small business owners can see their financial health at a glance. It reduces errors that happen with manual record-keeping.

Automating Invoicing And Payments

Sending invoices and receiving payments can take time. Finance software automates these tasks to speed up cash flow. It sends invoices on schedule and reminds customers about due payments. Faster payments mean more steady cash flow. Automation also reduces the risk of late or missed payments.

Forecasting Financial Trends

Finance software analyzes past data to predict future cash flow. It helps identify busy and slow periods for the business. This forecasting allows better planning for expenses and investments. Small business owners can prepare for challenges ahead. It supports making smart financial choices based on real data.

Enhancing Decision Making

Making good decisions is key for small business success. Finance software helps business owners choose wisely. It provides clear data and useful tools. This support leads to smarter decisions that save money and time. It also helps avoid costly mistakes.

Access To Real-time Data

Finance software shows current financial information instantly. Business owners see sales, expenses, and cash flow in real-time. This helps them respond quickly to changes. No more waiting for monthly reports. Quick access keeps the business on track.

Generating Detailed Reports

Detailed reports give a full picture of finances. Finance software can create these reports automatically. Business owners get clear summaries of income and spending. These reports make it easier to understand where money goes. They help spot problems early and plan better budgets.

Identifying Growth Opportunities

Finance software analyzes data to find new chances for growth. It highlights profitable products and services. It also shows areas that need improvement. Business owners can focus on what works best. This leads to better plans and steady growth.

Credit: stacker.com

Boosting Productivity And Collaboration

Boosting productivity and collaboration is essential for small businesses. Finance software helps teams work faster and together more easily. It reduces mistakes and saves time. Clear access to financial data supports better decisions. Teams can focus on growth instead of paperwork.

Centralizing Financial Information

Finance software stores all financial data in one place. No more searching through files or spreadsheets. This central hub keeps information organized and easy to find. Everyone uses the same data, which avoids confusion. Centralized info means faster reporting and review.

Facilitating Team Access

Team members can access financial data anytime and anywhere. Cloud-based software allows remote work without delays. Access controls keep data secure while sharing with the right people. Teams can update records in real time. This improves communication and reduces repeated work.

Integrating With Other Business Tools

Finance software connects with tools like invoicing, payroll, and inventory. Integration keeps all systems synced and accurate. It reduces manual entry and errors across platforms. Automation saves time and effort daily. Connected tools help teams coordinate tasks smoothly.

Choosing The Right Finance Software

Choosing the right finance software is a key step for any small business. The right tool helps manage money, saves time, and reduces errors. It fits your business needs and grows with you. Careful selection makes daily tasks easier and financial reports clearer.

Assessing Business Needs

Start by listing what your business requires from finance software. Track expenses? Manage invoices? Handle payroll? Different businesses have different needs. Know the size of your business and your budget. This helps avoid paying for features you don’t need.

Evaluating Features And Pricing

Compare software features side by side. Look for core tools like expense tracking, invoicing, and tax support. Check if the software offers reports that help business decisions. Pricing matters. Some software charges monthly, others yearly. Choose a plan that fits your cash flow.

Ensuring Ease Of Use And Support

Choose software with a simple interface. You want to save time, not waste it. Good customer support is vital. Problems will happen. Quick help keeps your business running smoothly. Look for tutorials, live chat, or phone support options.

Credit: growth.techforing.com

Frequently Asked Questions

What Are The Main Benefits Of Finance Software For Small Businesses?

Finance software helps small businesses manage cash flow, track expenses, and automate invoicing. It saves time, reduces errors, and improves financial accuracy. This leads to better decision-making and increased profitability for small business owners.

How Does Finance Software Improve Small Business Accounting?

Finance software automates bookkeeping tasks, organizes transactions, and generates financial reports. It simplifies tax preparation and ensures compliance. This reduces manual errors and provides clear financial insights for small business accounting.

Can Finance Software Help Small Businesses Save Money?

Yes, finance software reduces the need for costly manual processes and external accountants. It identifies spending patterns and helps control expenses. Overall, it boosts efficiency and cuts unnecessary costs in small business operations.

Is Finance Software Easy For Small Business Owners To Use?

Most finance software offers user-friendly interfaces designed for non-accountants. It includes tutorials, customer support, and automation features. This makes it accessible and practical for small business owners with limited financial expertise.

Conclusion

Small businesses gain control over their money with finance software. It saves time and reduces errors in daily tasks. Business owners can easily track income, expenses, and profits. Clear reports help in making smart decisions fast. Using this software keeps finances organized and stress-free.

It supports growth by showing where to cut costs. Simple tools bring big benefits to any small company. Choosing finance software is a step toward success. Easy, efficient, and helpful—just what small businesses need.